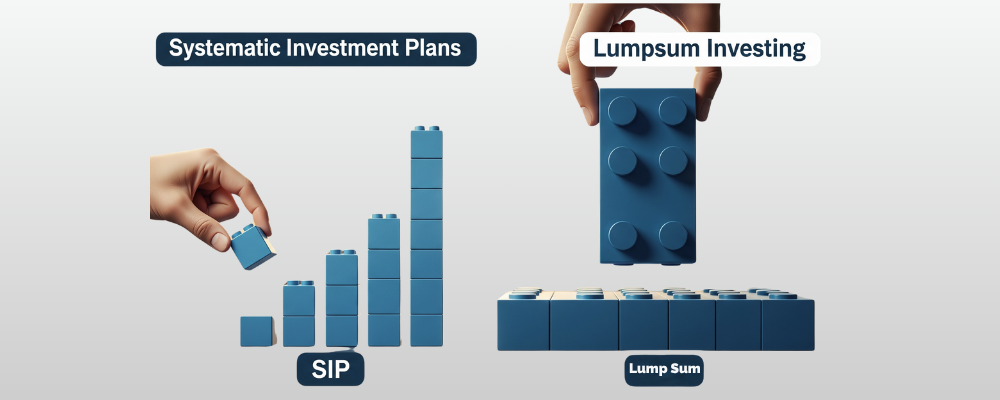

Let’s look at a situation: You’ve spoken with our experts at Investwise Finance and have understood the benefits of investing in Mutual Funds. You want to begin now, and that’s great. But there is one question looming in your mind. SIP karu ya Lumpsum daal du? Let’s discuss in this blog, what is better – SIP or Lumpsum investing?

The Crossroads

Both options are powerful paths to wealth creation, but each works best under different circumstances and for different types of investors. Choosing isn’t about which one is “better” in general, but rather which one is better for you.

- Lumpsum Investment: The ‘Go Big or Go Home’ Approach

Think of a lump sum investment as a one-time purchase. You have a significant amount of money at your disposal – perhaps from a year-end bonus, an inheritance, or the sale of an asset – and you decide to deploy it all at once into a specific mutual fund scheme.

- The ‘Big Bang’ Investment: This method operates on the principle that you have found a great opportunity and want to fully capitalize on it immediately. You are essentially making a “big bang” investment, hoping that the market will rise from the moment you invest.

- Capital Commitment: The defining characteristic is the full commitment of your capital from the very beginning. Your entire investment corpus starts working for you from day one, which can be both a blessing and a challenge.

- Risk and Reward: In a lump-sum investment, your risk is concentrated at a single point in time. If you invest just before a major market rally, your returns can be phenomenal. However, if the market crashes the day after you invest, your entire portfolio will be hit hard. This strategy is often favoured by experienced investors who have a strong conviction about market trends and a higher risk tolerance.

- Systematic Investment Plan (SIP): The ‘Slow and Steady Wins the Race’ Method

A SIP is the antithesis of a lump sum. It’s a disciplined, automated, and regular investment strategy. Instead of investing all your money at once, you invest a fixed amount at predefined intervals, such as monthly or quarterly.

- The ‘Drip, Drip, Drip’ Strategy: A SIP works like a leaky faucet – a small, steady drip that eventually fills a bucket. It’s about consistency and patience, not about timing the market. This method is perfect for investors who have a regular source of income and want to build a disciplined savings habit.

- Rupee Cost Averaging (RCA) – The Magic of SIP: This is the most powerful concept behind SIPs. Here’s how it works: With SIPs, you invest a fixed amount at regular intervals. When the market is high, you buy fewer units, and when it’s low, you buy more. Over time, this averages out your cost per unit, reducing the risk of entering the market at the wrong time. It helps you benefit from both highs and lows, making market volatility work in your favour and bringing more stability to your investment journey.

- The Power of Compounding: SIPs leverage the magic of compounding to its fullest. By investing small amounts regularly over a long period, your returns start generating their returns, leading to exponential growth. The earlier you start your SIP, the more time compounding has to work its magic.

“The right mindset can turn market dips into golden opportunities — because in investing, it’s not just about timing the market, it’s about training your mind to see possibilities where others see panic.” Harsh Shah (Founder Invetwise Finance)

TL;DR

| Aspect | SIP | Lumpsum Investment |

|---|---|---|

| Investment Style | Invests a fixed amount regularly (monthly/quarterly) | Invests a large amount in one go |

| Market Timing Risk | Low–cost is averaged over time (Rupee Cost Averaging) | High Entry point matters a lot |

| Volatility Handling | Handles volatility well by buying in both highs and lows | Sensitive to short-term market fluctuations |

| Affordability | Suitable for small, regular savings | Requires a large amount up front |

| Discipline | Encourages consistent saving habits | No built-in discipline after initial investment |

| Returns Potential | May benefit from averaging in volatile markets | Can earn higher returns if invested during a market low |

| Flexibility | Can start/stop or change the amount anytime | Less flexible once invested |

| Ideal For | New investors, salaried individuals, and those wanting gradual exposure | Investors with lump sum funds, good market knowledge, and a higher risk appetite |

The best choice is the one that aligns with your financial situation, goals, and risk tolerance.

Frequently Asked Questions (FAQs)

- Can I do both SIP and Lump Sum?

Yes! Combining both strategies is often the best approach. SIPs for discipline, lump sum for deploying surplus.

- Which gives better returns — SIP or Lump Sum?

In a consistently rising market, a lump sum may perform better. But over the long term, SIPs can match or beat a lump sum with reduced volatility.

- Is SIP safe?

SIPs invest in mutual funds, so they carry market risk. However, SIPs help reduce risk through averaging.

- What if I miss a SIP?

No problem. SIPs can be resumed next month. Some banks charge a penalty and missed investments affect long-term goals.

Tip from Investwise:

If you’re unsure, start with a SIP and gradually invest more when the market dips. You don’t need to get it perfect – just get started.

Whether you’re saving for the first time or already investing, we’ll guide you step-by-step so you feel confident about your money.

Visit https://investwise.finance/ or Whatsapp on +91 7738 676 026.